Medical Marijuana Tax Exemption Information

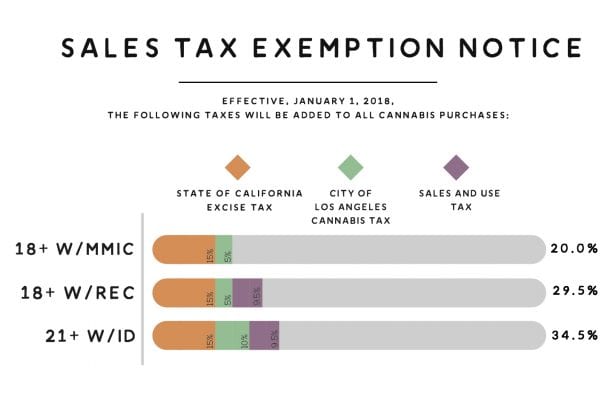

If you have a valid medical marijuana recommendation from a doctor, you qualify for 5% Local Tax exemption from the City of Los Angeles Cannabis Tax but are not exempt from Sales and Use Tax. Recommendation holders must prove they are 18 years old or older with a valid ID. Upload your recommendation from this link or send an email to support@kushfly.com to adjust your tax status.

*Nine Digit ID number validation at http://mmic.cdph.ca.gov/MMIC_Search.aspx

Medical Marijuana Program Application/Renewal Form: https://www.cdph.ca.gov/CDPH%20Document%20Library/ControlledForms/cdph9042.pdf

Click here for more information from the state website.

Tax Exemption for Medical Marijuana Recommendation Holders

If you’re have a valid medical marijuana recommendation from a doctor, you get 5% Local Tax exemption from City of Los Angeles Cannabis Tax but not exempt from Sales and Use Tax. Recommendation holders must prove they are 18 years old or older with a valid ID. Upload your recommendation from this link or send an email to support@kushfly.com to adjust your tax status.

To get a medical marijuana recommendation, click here.

How to claim a sales tax exemption on medicinal marijuana:

You can waive the 9.5% California Sales & Use Tax on medicinal marijuana by obtaining a state-issued Medical Marijuana Identification Card (MMIC).

Items needed for MMIC:

- Government issued Photo ID Card (CA Driver’s License, CA State ID, U.S. Passport, Veteran’s Administration ID Card)

- Your existing medical marijuana recommendation (must include your physician’s original signature)

- Proof of residency in California (utility bill, CA vehicle registration, lease/mortgage agreement)

- Complete Medical Marijuana Identification Card (MMIC) Application/Renewal – Form 9042

- Application fee of $100 ($50 for Medi-Cal Participants)